All Categories

Featured

In 2020, an approximated 13.6 million U.S. families are approved capitalists. These houses regulate huge wide range, approximated at over $73 trillion, which stands for over 76% of all private riches in the U.S. These investors join investment chances generally inaccessible to non-accredited investors, such as financial investments secretive firms and offerings by particular hedge funds, personal equity funds, and venture capital funds, which allow them to grow their wealth.

Review on for information regarding the most up to date recognized capitalist alterations. Resources is the fuel that runs the financial engine of any nation. Financial institutions generally fund the bulk, however hardly ever all, of the resources required of any procurement. After that there are scenarios like startups, where banks do not supply any financing at all, as they are unverified and considered high-risk, however the need for resources stays.

There are primarily two policies that allow providers of safety and securities to provide limitless amounts of safety and securities to financiers. accredited finance. Among them is Policy 506(b) of Guideline D, which permits an issuer to sell protections to unlimited recognized financiers and approximately 35 Sophisticated Investors only if the offering is NOT made through basic solicitation and general advertising

The recently adopted changes for the first time accredit private financiers based upon monetary elegance needs. Numerous other changes made to Rule 215 and Regulation 114 A clarify and broaden the listing of entity kinds that can certify as an approved investor. Right here are a few highlights. The changes to the certified financier interpretation in Guideline 501(a): include as accredited investors any type of depend on, with complete possessions greater than $5 million, not created particularly to buy the subject safety and securities, whose purchase is directed by an advanced individual, or include as recognized financiers any entity in which all the equity proprietors are recognized investors.

And now that you understand what it means, see 4 Real Estate Advertising and marketing approaches to bring in recognized financiers. Internet Site DQYDJ PostInvestor.govSEC Proposed changes to interpretation of Accredited InvestorSEC modernizes the Accredited Investor Meaning. Under the government safeties laws, a company may not use or sell safety and securities to investors without registration with the SEC. However, there are a variety of registration exceptions that ultimately expand deep space of potential investors. Numerous exemptions need that the investment offering be made only to persons that are recognized investors.

Furthermore, certified capitalists typically obtain much more beneficial terms and greater prospective returns than what is readily available to the public. This is because personal placements and hedge funds are not needed to adhere to the very same governing needs as public offerings, enabling even more versatility in terms of investment approaches and potential returns.

Sec Rule 501 Of Regulation D

One factor these protection offerings are restricted to recognized investors is to guarantee that all participating investors are monetarily advanced and able to fend for themselves or maintain the risk of loss, hence making unnecessary the protections that originate from a licensed offering. Unlike safety offerings signed up with the SEC in which certain details is called for to be divulged, business and personal funds, such as a hedge fund - non-accredited investors or financial backing fund, engaging in these excluded offerings do not need to make proposed disclosures to recognized financiers.

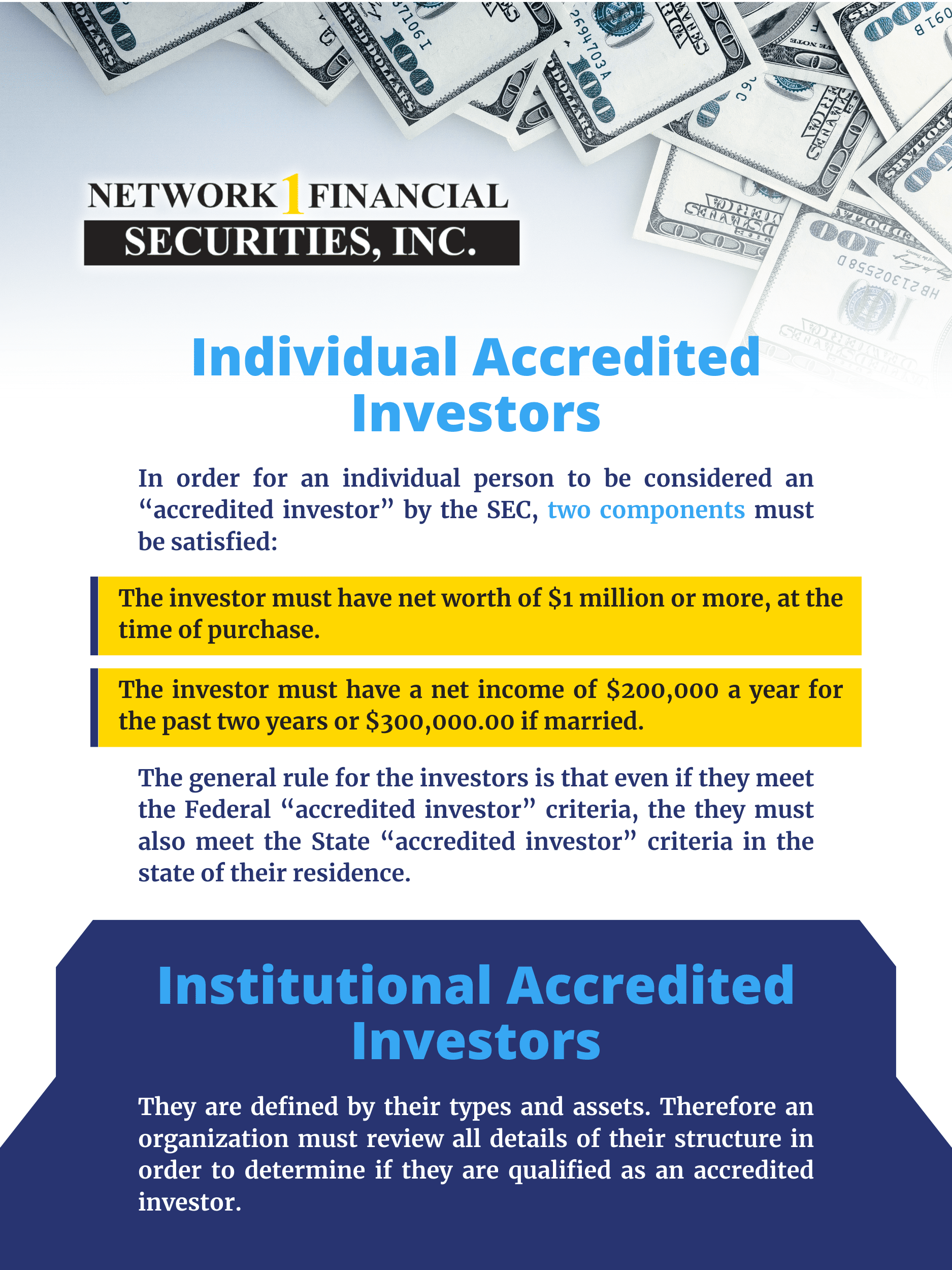

The web worth test is relatively easy. Either you have a million dollars, or you do not. On the income examination, the individual must please the thresholds for the 3 years consistently either alone or with a partner, and can not, for instance, please one year based on specific income and the next two years based on joint income with a partner.

Latest Posts

State Tax Foreclosure

Nonpayment Of Property Taxes

Tax Ease Lien Investments 1 Llc